This is part of a sponsored collaboration with The College Board and DiMe Media. However, all opinions expressed are my own.

When my daughter mentioned she wanted to attend a private college, I knew that the costs would be more than we could afford. We completed the FAFSA (Free Application for Federal Student Aid) and waited to hear back from the college about her financial package. I’m grateful she secured an academic scholarship and a couple of grants to cover the bulk of her expenses. Some families don’t realize how much they could save by simply completing this application. If you have a child that’s attending college next fall, find out why you need to file the FAFSA now.

5 Reasons to File the FAFSA Now

You don’t have to wait until tax season

To complete the FAFSA, you will need tax information from two years prior. What this means is that for the 2017-2018 FAFSA you will use your 2015 tax information. This recent change gives families a head start in completing the FAFSA. Gone are the days of estimating income or waiting until taxes are filed.

It’s easy to file and it’s FREE!

The FAFSA can be completed online at fafsa.gov and it’s 100% free. The first time I completed the application I was surprised by how easy the process was. You can even use the IRS Data Retrieval Tool which retrieves your tax information from the IRS. I highly recommend doing this as it’s one of the best ways to ensure that your FAFSA tax return information is accurate.

Your child might qualify for grants

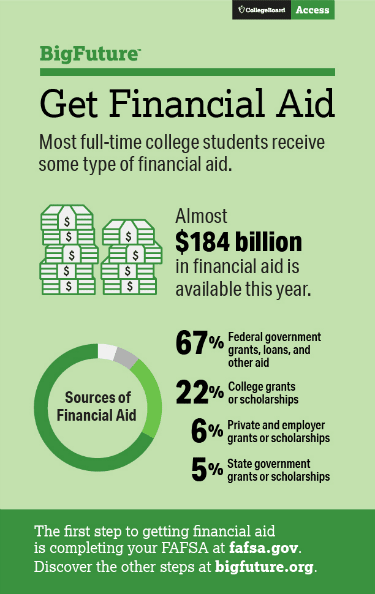

Almost $184 billion in financial aid is available, and most full-time college students receive some type of financial aid. In fact, the average financial aid award in 2014-15 was $14,210! Don’t assume that your family’s income is too high for grants or other forms of financial aid. The only way you’ll be certain about eligibility is by completing the FAFSA. State and federal grants have individual deadlines, so file as early as possible to ensure that your child is considered for all forms of aid.

Some colleges require it for scholarships

Depending on the school your child plans to attend, you might still be required to file a FAFSA. Some colleges use the FAFSA to determine the amount of merit-based scholarships. Even if your child doesn’t qualify for need-based aid, completing a FAFSA could open the door to other types of financial resources including federal student loans.

Your finances could change

Don’t skip filing, just because your family can currently afford to pay for all college expenses. Your family’s financial situation could suddenly change due to a job loss, illness, death or change in marital status. By not filing a FAFSA, you could run the risk of not having access to any financial assistance.

There are many resources available to you and your child during this important transition. One of our favorite web resources is the BigFuture website by The College Board. Students can search for and compare colleges, find scholarships, understand financial aid, navigate the college application process from start to finish. Your student can also receive personalized deadline reminders, tips, and guidance along the way. I highly suggest reading the article How to Complete the FAFSA – which can help you through the application process.

Another resource is the CollegeGo mobile app which guides students through the essential steps in the college application process with an interactive interface that uses game, video, and search features to help students plan their college journeys.

The College Board has also created Spanish language resources for parents and families to help their children plan for college. If your child is in 11th grade click here, and for 12th grade click here.

Now it’s up to you to take the first step. Complete the FAFSA today!

Leave a comment