This blog post was written as part of a sponsored program for State Farm®. All views expressed are entirely my own.

Approximately 6 years ago, I became very ill. Unfortunately, the doctors couldn’t figure out what was wrong. My blood count was low, I was losing weight at a rapid rate, and I was constantly feeling faint. I quickly came to terms that a weekly visit to the emergency room was my new norm. During this time I started to seriously think about all the potential outcomes. What would my husband do if I passed away? How would he manage the kids? Manage the home? Although I was concerned about my health, I couldn’t stop thinking about the possible burden my family would face in my absence.

I’m grateful that a year later I fully regained my health, and this past weekend I was able to celebrate another Mother’s Day with my family. My kids are my world, but the reality is that tomorrow is never guaranteed. If I want to ensure that my family is taken care of, I have to be proactive with the financial decisions I make. At minimum this includes having a will, and life insurance coverage.

Even if I wasn’t supplementing our household income, there are several tasks I handle every single day. In fact, I thought about what it would cost to hire someone to do these things, and the total would easily surpass six figures! It doesn’t matter if you’re a stay-at-home mom, everything you do for your family has value. How much value? Here’s a breakdown of a few job titles that moms hold, along with each position’s *average salary:

Cook ($41,500)

Think about the number of meals you cook each week. Sometimes it feels like I never get out of the kitchen. Oh, and let’s not forget about meal planning or grocery shopping with kids in tow.

Housekeeper ($20,740)

I call this my second day job, except I get zero vacation days. Plus my busy toddler ensures I never run out of things to do.

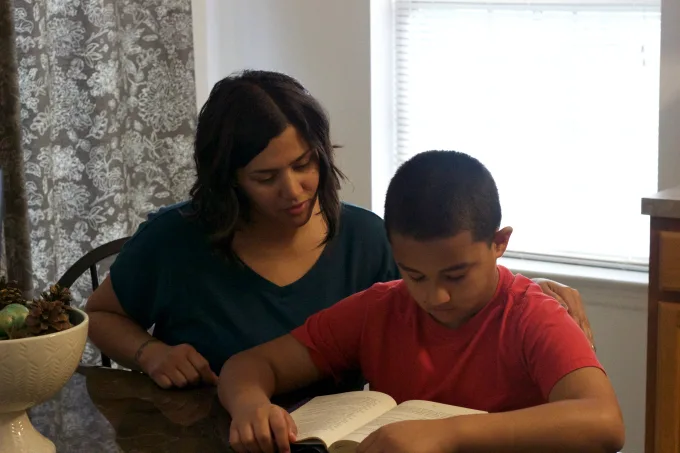

Teacher ($54,550)

We’re a homeschooling family, which means I’m very involved in my children’s education. But even if you don’t homeschool, I’m sure you still help your school-aged kids with homework and projects.

Laundry Attendant ($20,820)

I loathe laundry, and I would have no problem outsourcing this job if I could. In order to keep up, I have to wash a load every single day. It’s safe to say that I’m an expert in this field.

Chauffeur ($23,510)

Now that my teen drives, this has eased up a bit for me. But if your kids are still young and in various activities, you probably spend a good portion of your week behind the wheel.

Hairdresser ($23,660)

Do you wash, cut, and style your children’s hair? If you do, you can add this one to your job titles. An extra fee should be added for wiggly toddlers. 😉

The point I want to make is that what we do each day for our family is priceless, and, we need to ensure that their needs are taken care of if we’re no longer around. No one could ever replace us, but we can at least ease our families’ financial burden. I suggest reading the article Do You Really Need Life Insurance?– to get more insight on this topic. Not sure how much life insurance you need? Check out this calculator to help you get a general idea. You can also contact a State Farm agent for additional help.

Are you a stay-at-home mom? Do you have life insurance? I’d love to hear your thoughts!

This blog post was written as part of a sponsored program for State Farm. All views expressed are entirely my own.

*All figures noted are national average estimates listed by the Bureau of Labor Statistics.

I actually own life insurance. Life insurance isn’t for the dead but the living. It’s a way for me to safeguard my kids future so they’re not worrying about how they’re going to take care of my funeral etc. I think everyone should have one.

My husband has it but I do not. I did not even think of it this way! Those numbers add up!

I am a SAHM and I homeschool my daughters. My husband would be IN SO MUCH trouble and grief if anything happened to me. he literally knows where nothing is or how anything runs in our home. We have basic insurance for me

Yuppers! As soon as I said “I Do” we got joint life insurance policies that will protect either one of us should something happen to the other one. The only thing we forgot to do is get a will….. adding that to my “must do list” now!

At least you’re a step ahead! Some don’t have either, so kudos to you. Thanks for sharing! 🙂

Once I’ve moved and have my own family I will most definetely get life insurance. You’ve opened my eyes to so many things I never knew!

Everyone needs life insurance. It is really important for all adults to have it because you just never know.

I completely agree Robin. Unfortunately, it’s something many overlook, especially stay-at-home moms. Thanks for stopping by!