This blog post was written as part of a sponsored program for State Farm®. All views expressed are entirely my own.

I recently had the opportunity to visit the city of Chicago, and gather with local freelancers to learn financial tips from a business coach. The event took place at Next Door® Chicago, which is a cafe, community space and learning lab that’s run by State Farm. They offer free financial education, one-on- one financial coaching, classes and work/meeting spaces. I love that this resource is available to the community, and I’m secretly wishing more spaces open in the future.

Today I want to share a bit of what I learned at the event. If you’re an entrepreneur, or dreaming of becoming one in the future, there are actions you can take now to ensure that you run a financially sound business. Here are some of my favorite tips.

Business Tips for Entrepreneur Moms

Separate business and personal

This should be one of the first steps you take. When I first started freelancing I failed to do this, which in turn created a huge financial mess. I quickly learned that I couldn’t intermingle the two. I suggest opening a separate bank account to deposit your business income and pay for your business expenses. This account will also provide you with a detailed record of your business income and expenses, which can make things easier when tax season rolls around.

It’s important to separate personal and business expenses. #FinEdu @nextdoorchicago @StateFarm #biztips pic.twitter.com/Yqut3qcxMe

— Jesenia Montanez (@JeseniaMontanez) August 12, 2016

Know your customer

Narrow down who your ideal customer is and figure out how you can best serve them. My blog’s mission is to provide solutions to busy moms who want to simplify their lives. When I share information on this blog, I ensure that it fits my mission, and that it provides a resource to my target audience. Running a business goes beyond numbers, and how you serve your clients should be a reflection of that.

Create a monthly budget

Being self-employed also means that your income is going to fluctuate every month. You’ll have to monitor your income and expenses closely to figure out how your business is doing. I personally prefer to underestimate my monthly business income and overestimate expenses, so I’m not caught off guard during a slower month. I also use two separate monthly budget sheets to track both business and personal expenses. I encourage you to check out the Next Door budget worksheet to help you get started.

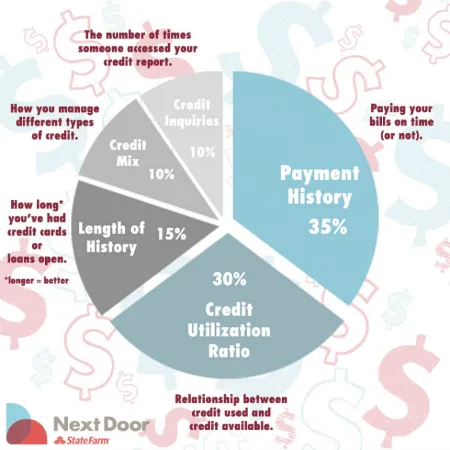

Know where your credit stands

When you launch a new business, you’ll have to rely on your own funds to pay for your start-up costs. Even if you’re paying for mosts of your business expenses up front, in certain situations, you might need to prove that you’re creditworthy. For example, my husband had his credit report evaluated in order to lease a retail space for his barber shop. If his credit had been less than stellar, he would have faced some financial hurdles. I suggest reading the article Five Financial Tips for Freelancers -to learn more about five factors that could impact your credit.

Reevaluate your benefits

Don’t forget why you decided to launch a business in the first place. Perhaps you wanted to supplement your family’s income, have more flexibility, or turn your passion into a profitable business. When you’re self-employed, you will need to cover your own benefits including major medical insurance. As your business grows, consider adding other benefits like disability insurance and retirement options. Don’t neglect your needs in the pursuit of financial freedom.

Are you an entrepreneur? I’d love to hear some of your financial tips!

This blog post was written as part of a sponsored program for State Farm. All views expressed are entirely my own.

Leave a comment