This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.

I’m finally coming out of the holiday fog and embracing the new year. To be honest, it wasn’t as busy as previous years. I was able to spend time with my family which included my daughter whom was home from college. In previous years, I had allowed myself to get so burned out from a long to-do list that family time took a backseat. This year I made sure to scale back and say “no” when necessary in order to be present for my loved ones.

Although the holiday season was over quickly, we were able to visit a couple of local attractions, bake Christmas treats, and watch several holiday movies together. It was nice to slow down and enjoy the little things that are often overlooked.

Once the new year arrived, I sat down with my husband to discuss our financial goals. Last year, our goal was to figure out where we would lay down roots and buy a home. We thought we had it figured out and even made a visit to a town we had thoroughly researched for years. Everything was going great and my husband even found a place work in his line of business. But once there, it never felt quite like home. Needless to say, I was very discouraged after that trip and felt like I was mourning a dream that would never be.

I know that things happen for a reason, and looking back I’m glad we didn’t make the move. Now it doesn’t mean we’re not trying to figure where our forever home will be. It just means that it will take a bit longer than expected, and it’s no longer a priority for us this year. Instead, we’re pushing forward to reach our financial goal of becoming 100% debt free and add new income streams.

If you set financial goals for yourself this year, here are some tips to help you in your journey:

Set a strong foundation

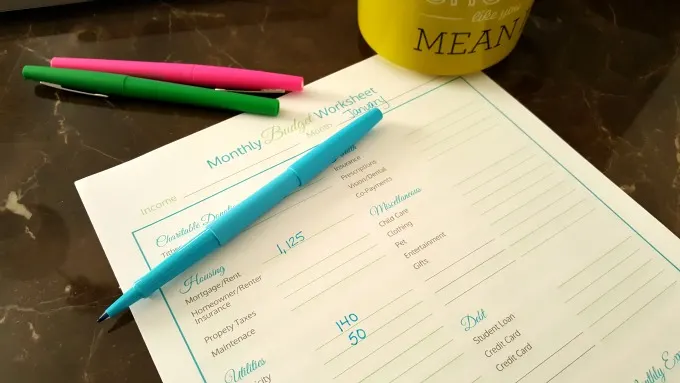

In order to reach your financial goals, you need to have the right financial tools. Take the time to look at your income and expenses in detail. This information will help you create a monthly budget and figure out how much money you can put towards savings or debt. I’ve learned over the years that being organized is the key to a solid financial foundation. Do you want to add more to your personal savings? Or start saving for the down payment on a new home? Check out SunTrust’s onUp website which offers several financial tools to help you reach your goals. My personal favorite is the savings calculator. It tells us how long it will take to reach our goal based on how much money we need and how much we’re investing.

Be specific

Instead of saying “I want to save $5,000 this year”, break it down even further. One of our goals is to save enough for a a future car purchase. My car is 13 years old and creeping up in the mileage department. I know we’ll eventually have to replace it, so I have to save now in order to have a enough money to buy a “new to me” car. Calculate how much you’ll need, and break it down into a monthly and weekly figure. This will also make your “big” goal more manageable.

Keep it simple

When it comes to finances, I like to keep it simple and focus on the basics. I don’t want to overcomplicate things and get off track in the process. Creating a budget and setting actionable goals should be part of your plan. It’s great to have good intentions, but taking action will make your dream a reality. I recently took the SunTrust’s Mental Wealth Quiz and it gave me feedback on how I can keep myself motivated (an area I struggle with). It specifically said that I should write down my top goal and place it somewhere I can see it everyday. I plan to create a vision board that includes our financial goals for the year.

Did you set financial goals for the new year? Learn how SunTrust Bank can help you reach your goals and help you focus on what matters.

At SunTrust Bank their purpose is lighting the way to financial well-being. When you feel confident about your money, you can save for your goals and spend knowingly on what matters most to you.

The onUp movement was created to guide millions of people one step at a time towards a more financially confident life without ever losing sight of the moments that matter along the way.

Join the growing number of people transforming their stress into positive motivation to move onUp.

Leave a comment