This is a sponsored conversation written by me on behalf of Netspend. The opinions and text are all mine.

When it comes to finances, I prefer to keep things simple and focus on the basics. My main goal is to track our spending and stay within our budget. Although I’ve learned what works for our family, it wasn’t always that way. For several years, we spent more money than what we earned. Although we went through some financial setbacks that forced us to buckle down on our spending, a lot of the debt we accumulated was a direct result of our poor money management.

Today I want to share my favorite tips that help me manage our finances and track our spending. I can’t go back in time and undo the mistakes I’ve made, but I can certainly learn from them and make smarter choices going forward.

Create a budget

I know the thought of creating a budget can be daunting, but it doesn’t have to be! You don’t need fancy worksheets or a financing degree to track where your money is going. By following these five simple steps you can simplify the budgeting process and take control of your finances:

- Calculate your monthly income – Include all income sources: salary, sideline business, tax refunds etc. Take the yearly figure and divide by twelve to get your monthly income.

- List all expenses – Include all your fixed expenses: mortgage/rent, insurance, taxes, loans and fixed utilities. You’ll also need to figure out what the monthly average is for your variable expenses: food, clothing, gas, medical, gifts, etc.

Once you know how much you spend in each area, it’ll be much easier to distribute your income and stick with your budget. If you need a free budget worksheet to help you get started, click here.

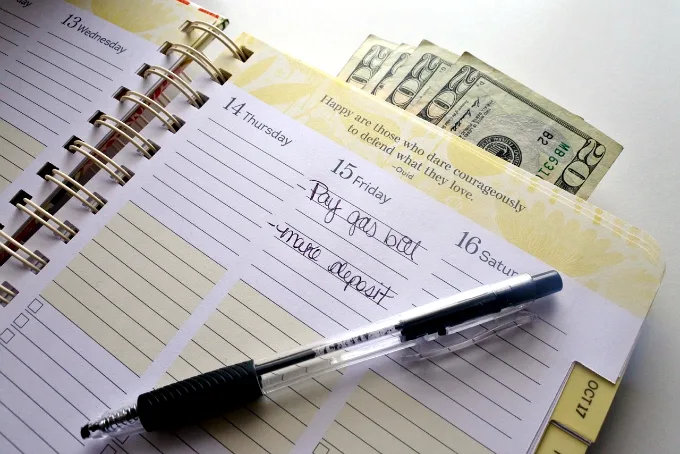

Track your spending

I highly recommend that you track your spending, otherwise, you won’t know where your money is going. This simple step will help you stay within your budget and make adjustments if necessary. There are several free apps that allow you to easily enter and track your monthly purchases, but if you prefer to write it down, you can use a spending tracker worksheet like this one.

Use a prepaid debit card

I’m not a fan of carrying cash to pay for my purchases. I’ve lost my wallet more times than I care to count so it’s simply not an option for me. Instead, I prefer to use a prepaid card that can be used where I need it – to buy groceries, pay bills, and shop online. One great option is the Netspend Prepaid Debit Card which requires no credit check, no minimum balance, and no activation fee.

The Netspend Prepaid Card can be used everywhere Visa debit / Debit Mastercard is accepted, respectively, which gives you financial freedom and convenience. You can also enroll in Anytime Alerts to receive alerts after every transaction so you can stay on top of your account. The process is simple; pay bills, reload and spend smarter.

The Netspend Prepaid Card can be used everywhere Visa debit / Debit Mastercard is accepted, respectively, which gives you financial freedom and convenience. You can also enroll in Anytime Alerts to receive alerts after every transaction so you can stay on top of your account. The process is simple; pay bills, reload and spend smarter.

What are your financial goals this year? What steps are you taking to manage your money better? As always, I’d love to hear from you!

Leave a comment