As I mentioned earlier this year, my husband and I have big financial goals for 2016. We sat down to make sure we were on the same page and to hash out some details. I find that finances can be a sticky subject amongst couples. Although we’ve always combined our income and never kept financial secrets from each other, we still have to make an effort to talk openly about money.

One of the first things we did after our chat was simplify our finances and get organized. You would think that I already had this mastered, but I find that towards the end of the year we begin to lose traction (no bueno). So this year we’re simplifying our systems and focusing on the basics. I find that the more complicated things are, the easier it is to get off track. So today I’m sharing some of the areas we’ve been focusing on this year and hopefully it will help you in your own financial journey.

Simplify and Organize Your Finances

Figure out your monthly income and expenses

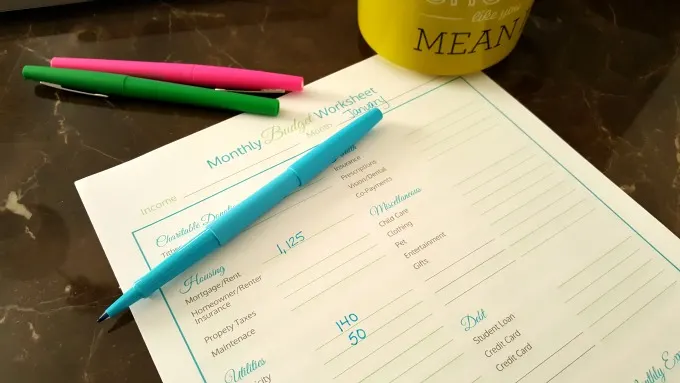

Simple right? But since both my husband and I are self-employed, it means I have to watch our income closely since it varies every month. I like to underestimate our income, so that we don’t get caught off guard during a “slow” month. I also use a monthly budget sheet (print here) to figure out our monthly expenses. We switched some of our utility providers and joined a new healthcare network, so it was the perfect time to re-calculate things and update our budget.

Figure out your total debt

I thought I knew what our total debt was until I decided to pull our free credit report recently and found a couple of surprises. You may think that you’re in the clear, but in reality you might have a small balance pending from a medical bill your insurance denied (yup, I just found out). Thank God is was nothing major, but sure enough it’s a debt we have to pay. We’re currently following (affiliate) Dave Ramsey’s debt snowball concept to repay our debt and I find it works best for us.

Set specific financial goals

It’s easy to say “I want to save $10,000 this year”, however, you need to be more specific. One of our goals is to save enough for a a future car purchase. My car is 12 years old and creeping up in the mileage department. I prefer driving an older car, instead of acquiring car debt. But since I know we’ll eventually have to replace my car, I have to start saving a specific monthly figure to reach our goal. So figure out how much you’ll need, and break it down monthly, or even weekly. It will make your “big” goal appear less daunting.

Set yourself up for success

Once you’ve figured out your monthly income/expenses, total debt and your financial goals, set yourself up for success with the right tools. The first thing I did was download an app (Expensify) that will help us keep track of everything we spend on our businesses. In the past, I’ve misplaced receipts and records that could have helped us lower our tax liability. I learned a very expensive lesson and want to make sure that going forward every penny is accounted for. Get organized with printables, free apps such as YNAB, and schedule financial meetings with your spouse to keep each other accountable.

Separate business and personal

This will only apply to you, if you own a business. I can’t stress how important this is and why you should make it a priority. I failed to do this in the past which created a mess with our finances. Open up a separate bank account for your business and keep a detailed record of your income/expenses. It will make tax season a lot easier to deal with and you’ll also know the financial health of your business at all times.

How are you simplifying and organizing your finances? I’d love to hear from you!

Leave a comment